Reports

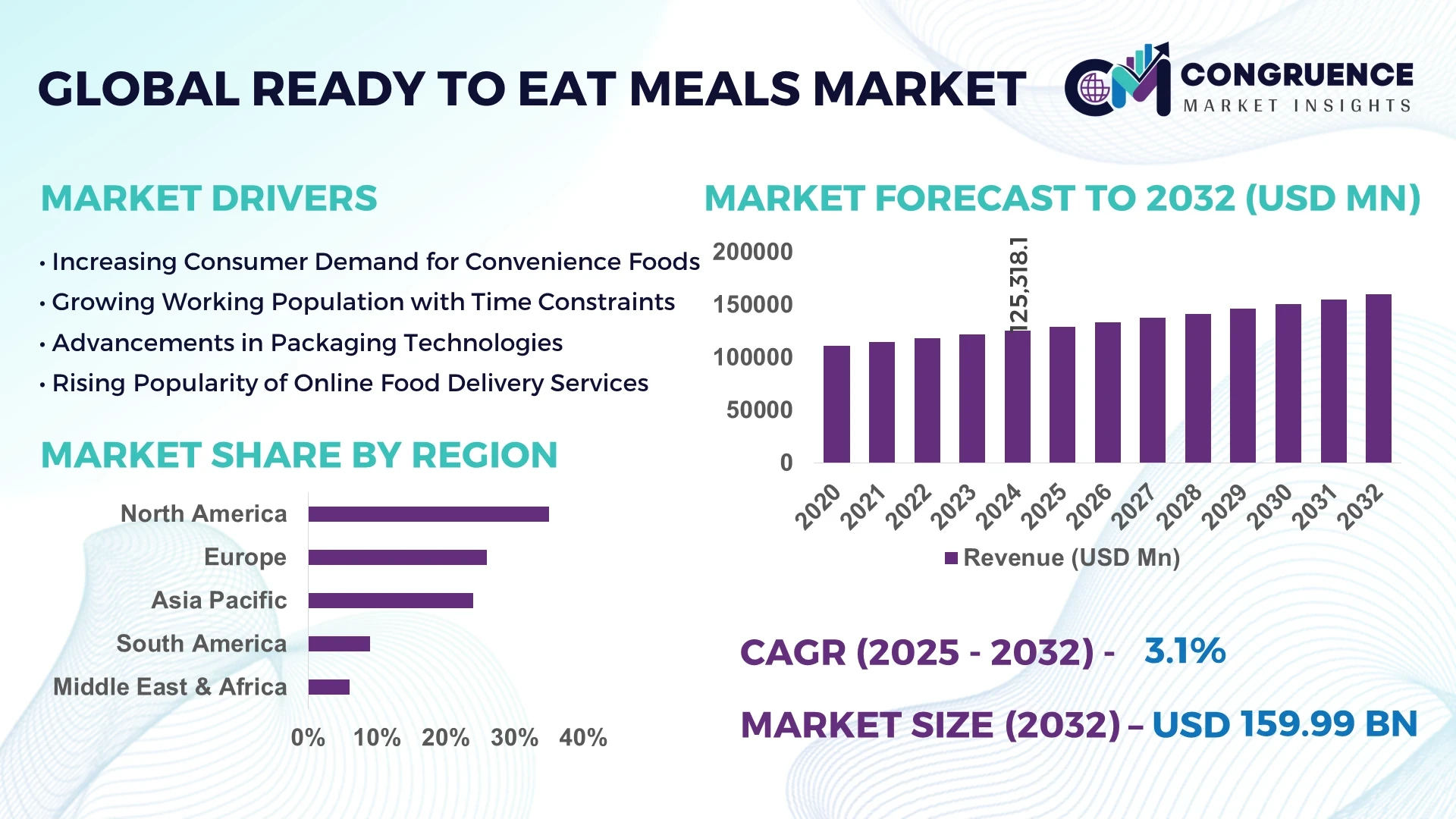

The Global Ready to Eat Meals Market was valued at USD 125,318.05 million in 2024 and is anticipated to reach a value of USD 159,986.35 million by 2032, expanding at a CAGR of 3.1% between 2025 and 2032.

This growth is driven by increasing consumer demand for convenient meal options that align with busy lifestyles.The market encompasses a variety of products, including frozen, chilled, canned, and shelf-stable meals, catering to diverse consumer preferences.Innovations in packaging and preservation technologies have enhanced the quality and shelf-life of these meals, making them more appealing to health-conscious consumers.The rise in single-person households and urbanization further contribute to the market's expansion, as more individuals seek quick and easy meal solutions.Additionally, the growing popularity of plant-based and vegan ready-to-eat meals reflects changing dietary trends and preferences.Manufacturers are also focusing on sustainable packaging solutions to meet environmental concerns, which is becoming an important factor for consumers.The integration of online retail channels has made these products more accessible, further driving market growth.Overall, the Ready to Eat Meals Market is poised for steady growth, adapting to evolving consumer needs and technological advancements.

Artificial Intelligence (AI) is significantly transforming the Ready to Eat (RTE) meals market by enabling enhanced personalization, optimization of production processes, and improving supply chain management. AI-driven technologies, including machine learning and data analytics, are helping companies predict consumer preferences, optimize menu offerings, and tailor RTE meals to regional tastes. With the ability to process vast amounts of data, AI can identify emerging food trends and consumer behavior patterns, allowing RTE meal providers to stay ahead of the competition. AI also plays a key role in optimizing production processes, ensuring better quality control, and reducing waste. Automated machines powered by AI are now capable of preparing meals at scale with consistent quality and accuracy. Furthermore, AI-based chatbots and recommendation engines are being integrated into RTE meal platforms, enabling personalized meal recommendations based on individual dietary preferences. As the market becomes more competitive, AI is proving to be a game-changer by enhancing operational efficiency, improving customer experience, and allowing for more customized food options.

"In 2024, AI-driven vending machines have gained traction, offering ready-to-eat meals with minimal human intervention.These machines utilize AI to monitor inventory levels, predict restocking needs, and provide personalized meal recommendations based on consumer preferences.This innovation enhances convenience and accessibility, particularly in urban areas where demand for quick meal solutions is high."

The Ready to Eat Meals Market is influenced by various dynamic factors that shape its growth and development. Market trends are shaped by changing consumer preferences, evolving food trends, and innovations in food technology. These dynamics are not only driven by demand but are also influenced by external factors such as economic conditions, societal changes, and technological advancements. Furthermore, as global markets continue to shift towards more convenience-driven food solutions, RTE meals are positioned to capture a significant share of the food industry, with innovations aimed at addressing both consumer demands for health and convenience.

Rising Demand for Convenient Meal Solutions

The increasing demand for convenient meal solutions is one of the key drivers of growth in the Ready to Eat Meals market. With busy work schedules, urbanization, and a fast-paced lifestyle, more consumers are seeking time-saving meal options. The global rise in single-person households and working professionals has led to greater reliance on RTE meals. As per recent surveys, 52% of consumers prefer pre-packaged meals due to their quick preparation time and convenience. Additionally, advancements in food preservation techniques ensure that these meals retain their flavor and nutritional value, further fueling their demand. Consumer awareness of the importance of healthy eating is also driving interest in RTE meals that are low in preservatives and artificial ingredients, thus expanding the market further.

Challenges in Shelf Life and Nutritional Value Preservation

Despite its growth, the Ready to Eat Meals market faces several challenges that could hinder its progress. One major restraint is the difficulty in maintaining the nutritional value and taste of RTE meals over time. While advancements in packaging technology have improved the shelf life of these meals, some consumers remain skeptical about the long-term preservation of nutrients and flavor. Additionally, there are concerns related to the high sodium and preservatives content in many RTE products, which can deter health-conscious consumers from opting for these meals. Stringent food safety regulations across different regions also pose a challenge to manufacturers, who must continuously innovate to meet these standards while ensuring product quality.

Growth in Plant-Based and Organic Ready to Eat Meals

One of the most promising opportunities in the Ready to Eat Meals market lies in the growing trend of plant-based and organic meal options. As more consumers shift towards vegan and vegetarian diets, the demand for plant-based RTE meals has skyrocketed. Reports show that plant-based meal offerings in the RTE segment have increased by over 30% in the last two years, with brands focusing on organic and sustainable ingredients. The rise of eco-conscious consumers is pushing manufacturers to introduce meals that are not only convenient but also environmentally friendly. This trend opens up new opportunities for companies to expand their product range to include organic, plant-based, and even gluten-free RTE meals.

Rising Costs of Ingredients and Production

A major challenge faced by the Ready to Eat Meals market is the rising costs of raw ingredients and production. The global supply chain disruptions and inflationary pressures have led to higher prices for essential food ingredients, such as meat, vegetables, and grains. Additionally, the costs associated with packaging materials, especially eco-friendly packaging, have surged. These increased production costs often result in higher prices for end consumers, which can limit the growth potential of RTE meals in price-sensitive markets. Companies in the market must continually find ways to optimize production processes and reduce waste to manage these cost pressures effectively.

The Ready to Eat Meals market has been witnessing several significant trends that reflect changing consumer behaviors and innovations in food technology. One of the leading trends is the growing demand for healthier, nutrient-dense options, with many brands now focusing on offering RTE meals that are low in calories, sugar, and artificial ingredients. This trend aligns with the global shift towards wellness and fitness, as consumers become more health-conscious.

Additionally, the increasing preference for plant-based and vegan options is reshaping the market, with a rise in demand for RTE meals that cater to these dietary preferences. In terms of technology, there has been a surge in the use of AI and automation in meal production, allowing for more personalized offerings and efficient production lines. Moreover, the use of smart packaging solutions, such as those incorporating QR codes or sensors to monitor meal freshness, is gaining popularity, enhancing consumer trust in the quality of RTE meals. These trends indicate a promising future for the RTE meals market, as innovation continues to drive the industry forward.

The Ready to Eat Meals Market is segmented by product type, application, and end-user insights. These segments help better understand consumer preferences, usage patterns, and the demands driving the market. The product types vary from frozen meals, chilled meals, canned meals, to retort packaged meals. Each of these categories appeals to different consumer groups based on their specific needs for convenience, preservation, and taste. In terms of application, the primary categories are residential/household consumption and commercial food services. These two applications highlight the increasing popularity of ready to eat meals in both home kitchens and food service industries. End-user insights are categorized into individual consumers and businesses like restaurants and cafes, each with unique demands for these products. This segmentation allows for a more granular analysis of market trends and growth areas.

North America accounted for the largest market share at 35% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 5.2% between 2025 and 2032.

North America continues to dominate the market, benefiting from a strong consumer base that favors the convenience of ready-to-eat meals. The United States, in particular, holds a significant portion of the market due to busy lifestyles and a higher preference for packaged meal options. In contrast, the Asia-Pacific region is rapidly gaining momentum due to an increasing urban population, higher disposable incomes, and a shift toward western eating habits. Moreover, regions such as Europe are witnessing steady growth due to growing awareness of healthy eating, sustainability, and product innovations.

Emerging Consumer Preferences and Market Dynamics

North America, especially the U.S., holds the largest share of the global ready-to-eat meals market. In 2024, this region accounted for around 35% of the global market share. Convenience-driven consumers are increasingly opting for these products, especially those who are seeking fast and easy meal solutions due to busy work schedules. Additionally, the market is experiencing a shift toward healthier options, such as organic and plant-based ready-to-eat meals. Meal kit delivery services, including prominent players like Blue Apron and HelloFresh, are also making significant strides in the North American market, contributing to the growth of the sector. The rapid expansion of e-commerce platforms and retail outlets that cater to ready-to-eat meals is expected to further boost the market in this region.

Key Growth Factors and Consumer Trends

In Europe, the demand for ready-to-eat meals is also seeing steady growth, accounting for roughly 30% of the global market share in 2024. The UK, Germany, and France are the main contributors to this growth, with increasing consumer interest in high-quality, sustainable meal solutions. There is a growing focus on organic, vegan, and gluten-free meal options as European consumers become more health-conscious. The trend toward eco-friendly packaging and food waste reduction is also driving innovations within the industry. Moreover, busy urban dwellers in cities across Europe are increasingly choosing ready-to-eat meals due to their convenience and nutritional value, with retailers expanding their ready-to-eat offerings in response.

Urbanization and Rising Disposable Incomes Driving Growth

Asia-Pacific is witnessing rapid growth in the ready-to-eat meals market, driven by urbanization, rising disposable incomes, and changing consumer lifestyles. The region is projected to grow significantly, expanding its market share from 20% in 2024. Countries such as China, India, and Japan are leading this trend, with busy professionals and a growing middle class opting for quick meal solutions. The demand for traditional Asian meals in ready-to-eat forms, like rice and noodle-based dishes, is soaring alongside the increasing preference for Western-style meals. With the rise of e-commerce platforms and online food delivery services, the accessibility of ready-to-eat meals is improving, especially in urban and semi-urban areas.

Growing Demand for Convenience and Modern Diet Solutions

The Middle East & Africa (MEA) region is gradually gaining traction in the global ready-to-eat meals market. While it currently holds a smaller share of approximately 10%, the region is expected to see strong growth over the next few years. Urbanization, a rising number of working professionals, and increasing disposable incomes in countries like the UAE, Saudi Arabia, and South Africa are key factors propelling the market. Consumers are seeking quick, convenient meal options, especially those that align with local preferences and dietary habits. The demand for halal and organic ready-to-eat meals is also rising in this region, creating opportunities for local and global brands to expand their offerings.

The ready to eat meals market is highly competitive, with both established global players and innovative local brands striving for market share. Major players such as Nestlé, Unilever, and Kraft Heinz lead the market by leveraging their extensive distribution networks and a broad range of product offerings. Nestlé, through its Maggi and Stouffer’s brands, continues to dominate the frozen and chilled ready-to-eat segments. Unilever’s Knorr range has also carved out a significant position in the market with an emphasis on sustainability and healthy eating. Newer market entrants like meal kit providers HelloFresh and Blue Apron are disrupting traditional retail models by offering customized meal solutions through online platforms. Additionally, local players in emerging markets, particularly in Asia-Pacific and the Middle East, are innovating with region-specific ready-to-eat meals to cater to local tastes and preferences.

Nestlé

Unilever

Kraft Heinz

Conagra Brands

Campbell Soup Company

Tyson Foods

Amcor

Hain Celestial Group

Del Monte Foods

HelloFresh

Blue Apron

The ready to eat meals market is undergoing significant technological advancements, especially in areas such as packaging, food production, and distribution. Key innovations have focused on enhancing convenience, extending shelf life, and improving sustainability. In recent years, smart packaging has gained traction, integrating sensors to monitor the freshness of meals and provide consumers with real-time data on product quality. Additionally, 3D food printing has been explored by several companies to create personalized meals with complex textures and flavors, using sustainable ingredients. This technology also enables manufacturers to cater to dietary preferences and restrictions more effectively. AI-powered systems are increasingly used for optimizing supply chain management, ensuring that meals are delivered efficiently from production facilities to consumers. As demand for plant-based and organic products rises, sustainable packaging has become another key area of development. Companies are increasingly focusing on using recyclable, biodegradable, and compostable materials to meet consumer demand for eco-friendly solutions. The integration of online platforms for meal ordering has also expanded, making it easier for consumers to access a variety of meal options from the comfort of their homes.

In March 2024, Nestlé launched a new range of plant-based ready-to-eat meals across North America and Europe. These meals are designed to meet the rising consumer demand for plant-based alternatives, with options including plant-based burgers, vegan pasta dishes, and ready-to-eat salads.

In January 2024, McDonald’s unveiled a new sustainable packaging initiative aimed at reducing plastic waste in its ready-to-eat meals. The company began using 100% recyclable packaging in select locations worldwide, targeting a complete switch by 2025.

In November 2023, Revo Foods, an Austrian food-tech company, launched a 3D-printed salmon filet alternative made from plant-based ingredients. This marks a significant advancement in sustainable meal alternatives, providing a high-protein, low-impact option for consumers.

In July 2023, HelloFresh, a leading meal kit delivery service, announced an expansion of its ready-to-eat meal offerings, introducing a range of quick, microwavable meals. This development is aimed at catering to the growing demand for convenience among busy professionals.

In February 2024, Marks & Spencer, a UK-based retailer, introduced a new line of healthy, low-calorie ready-to-eat meals, focusing on weight management and heart health. The meals are fortified with vitamins and minerals, catering to health-conscious consumers in the UK and Europe.

This report provides an in-depth analysis of the global ready-to-eat (RTE) meals market, covering key trends, technological advancements, and market dynamics shaping the industry. It examines the market by product type, application, and end-user insights, and offers a detailed look at regional market performance, with a special focus on North America, Europe, Asia-Pacific, and the Middle East & Africa. The report includes a comprehensive segmentation analysis to provide a clear understanding of market size, growth potential, and key drivers of demand across various categories.

Additionally, the report highlights key players in the market, along with their strategies, developments, and competitive landscape. As RTE meals gain popularity due to busy lifestyles and the increasing demand for convenient, healthy, and sustainable food options, this report offers valuable insights into the future of the market. It also outlines the regulatory landscape, key challenges, and future growth opportunities, making it an essential resource for stakeholders in the RTE meals supply chain, including manufacturers, retailers, and investors.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

125318.05 |

|

Market Revenue in 2032 |

159986.35 |

|

CAGR (2025 - 2032) |

0.031 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Nestlé, Unilever, Kraft Heinz, Conagra Brands, Campbell Soup Company, Tyson Foods, Amcor, Hain Celestial Group, Del Monte Foods, HelloFresh, Blue Apron |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |