Reports

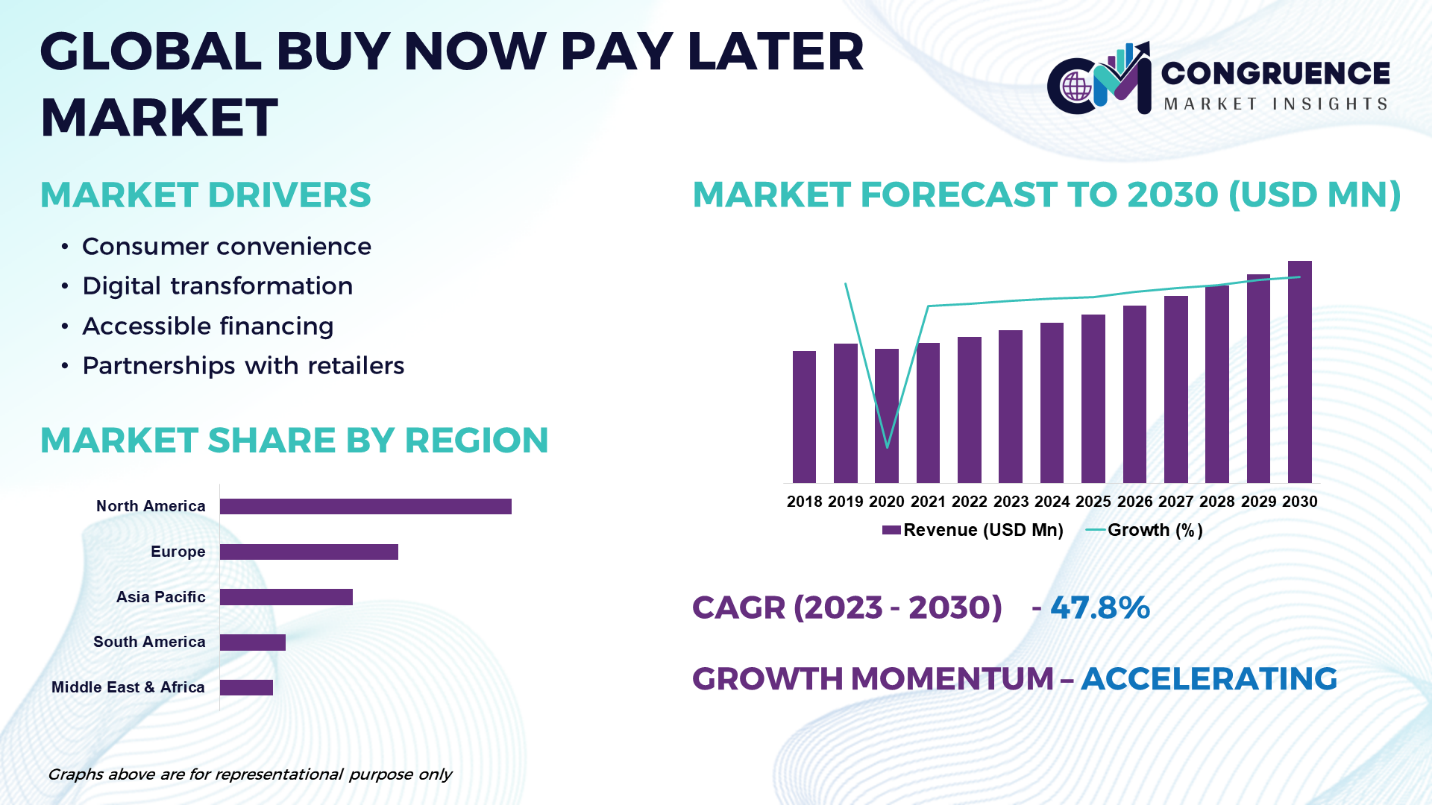

A financial service industry that has seen tremendous growth in recent years is buy now pay later (BNPL), which provides customers with a different way to make payments than they would with typical credit cards and loans. Customers can purchase under this model and postpone payment; they frequently choose installment plans with set payback dates. Third-party fintech companies who collaborate with retailers to incorporate their payment solutions into the checkout process are usually the ones offering BNPL services. Due to its accessibility, flexibility, and ease of use, BNPL is popular since it enables customers purchase goods and services without having to worry about paying for them right away. However, concerns have been raised regarding the potential for users to accumulate debt, and regulatory scrutiny has increased to ensure responsible lending practices within the BNPL industry. Despite these challenges, the Buy Now Pay Later market continues to expand globally, driven by evolving consumer preferences and the desire for more adaptable and personalized financial solutions. The Global Buy Now Pay Later Market is expected to expand at a CAGR of 47.8% between 2023 and 2030.

Buy Now Pay Later Market Major Driving Forces

Consumer Convenience: The Buy Now Pay Later (BNPL) market is driven by the convenience it offers to consumers. The ability to make purchases and defer payments through installment plans appeals to those seeking flexibility in managing their finances.

Digital Transformation: The rise of digital platforms and e-commerce has facilitated the growth of the BNPL market. Seamless integration of BNPL services into online checkout processes has become a key driver as consumers increasingly turn to digital channels for their shopping needs.

Accessible Financing: BNPL services provide a more accessible financing option compared to traditional credit cards or loans. This inclusivity attracts a broader consumer base, including those without established credit histories or those looking for alternatives to traditional credit.

Partnerships with Retailers: Collaboration between BNPL providers and retailers has fueled market expansion. Many major retailers now offer BNPL options at the point of sale, enhancing the visibility and adoption of these services among consumers.

Buy Now Pay Later Market Key Opportunities

Merchant Integration and Partnerships: Buy now pay later (BNPL) suppliers have a great chance to build and expand their relationships with a variety of merchants. More stores' checkout procedures that use BNPL services improve uptake and exposure, benefiting both merchants and providers.

Global Expansion: Bringing BNPL services to previously unexplored markets and new geographic areas offers a significant opportunity. Offering services to a variety of populations might help BNPL providers realize significant development potential as global consumer tastes change.

Innovative Product Offerings: In a competitive industry, BNPL providers can stand out by consistently launching new features, loyalty programs, and customized financing solutions. Creating distinctive and alluring value offerings might draw in a larger clientele.

Buy Market Pay Later Key Trends

· Interest in the BNPL sector was growing from governments and regulatory agencies.

· More and more BNPL suppliers were combining their offerings with well-known e-commerce sites.

· Traditional financial institutions and BNPL providers were investigating joint ventures and acquisitions.

· Big BNPL providers were aiming for new markets and extending their services around the globe.

· Sustainability was being incorporated into several BNPL providers' business plans.

· BNPL providers were implementing loyalty programs and awards to encourage user uptake and loyalty.

· Beyond conventional installment plans, BNPL suppliers were experimenting with new payment structures.

· Due to the diversification of services offered by both new and incumbent firms, the BNPL market was becoming more competitive.

· In order to improve the user experience, BNPL providers were making technological investments.

Market Competition Landscape

The intense rivalry between numerous manufacturers is a defining feature of the worldwide purchase now pay later business. In order to obtain a competitive edge, major firms in the purchase now pay later market employ certain techniques. To adapt to changing consumer tastes, these tactics include eco-friendly and sustainable material inclusion, design distinction, and product innovation. While more recent competitors concentrate on disruptive technologies and distinctive selling propositions, established businesses use their reputation for quality and dependability to hold onto market dominance. Prominent entities in the worldwide buy-now-pay-later industry employ diverse organic and inorganic tactics to fortify and enhance their market standing. Leading companies in the industry include:

· Afterpay (Square, Inc.)

· Affirm

· Klarna

· Zip Co Limited

· Sezzle

· Splitit

· Quadpay (Acquired by Zip Co)

· PayPal (Pay in 4)

· Openpay

· Laybuy

|

Report Attribute/Metric |

Details |

|

Base Year |

2022 |

|

Forecast Period |

2023 – 2030 |

|

Historical Data |

2018 to 2022 |

|

Forecast Unit |

Value (US$ Mn) |

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Segments Covered |

· By Component (Platform/Solutions, Services) · By Purchase Ticket Size (Small Ticket Item (Up to US$ 300), Mid Ticket Items (US$ 300 - US$ 1000), Higher Prime Segments (Above US$ 1000)) · By Business Model (Customer Driven, Business Driven) · By Mode (Online, Offline) · By Vertical (Home & Furniture, Electronics, Fashion, Others) |

|

Geographies Covered |

North America: U.S., Canada and Mexico Europe: Germany, France, U.K., Italy, Spain, and Rest of Europe Asia Pacific: China, India, Japan, South Korea, Southeast Asia, and Rest of Asia Pacific South America: Brazil, Argentina, and Rest of Latin America Middle East & Africa: GCC Countries, South Africa, and Rest of Middle East & Africa |

|

Key Players Analyzed |

Afterpay (Square, Inc.), Affirm, Klarna, Zip Co Limited, Sezzle, Splitit, Quadpay (Acquired by Zip Co), PayPal (Pay in 4), Openpay, Laybuy |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |