Reports

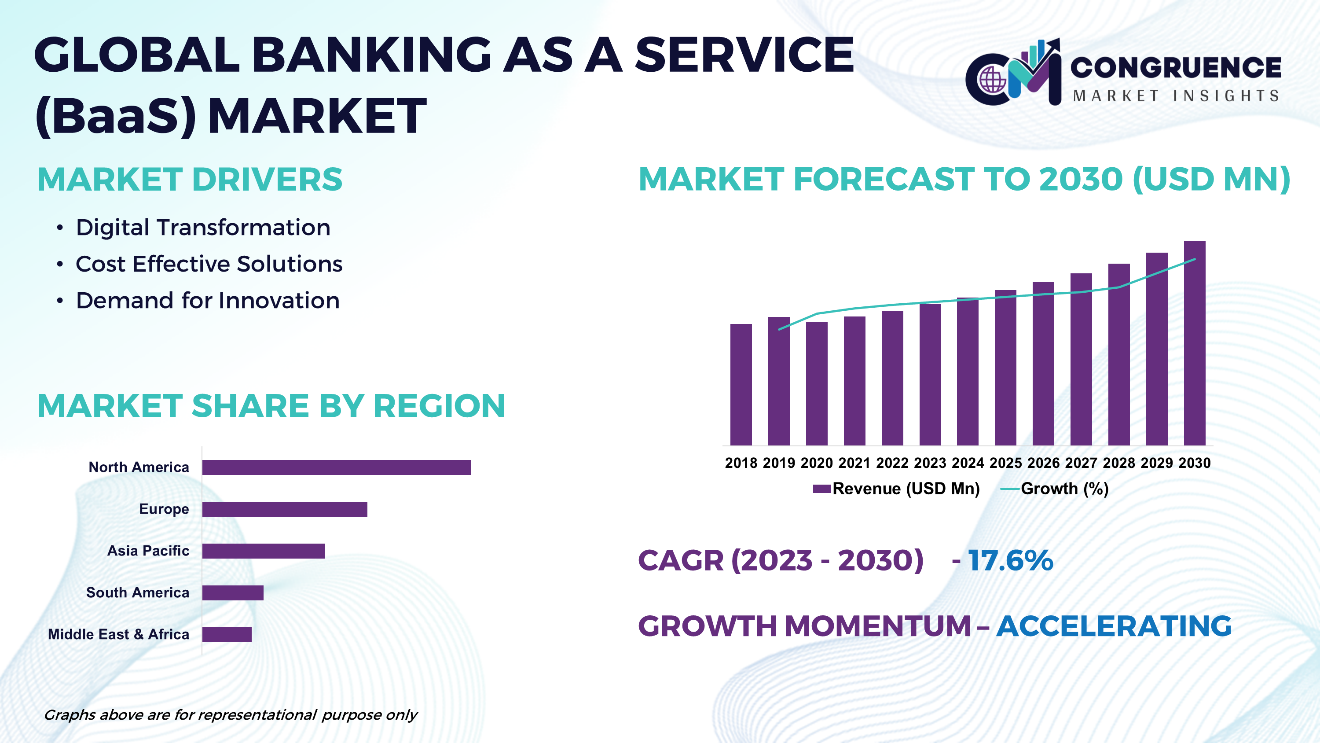

The Global Banking-as-a-Service (BaaS) Market is expected to expand at a CAGR of 17.6% between 2023 and 2030. Banking-as-a-Service (BaaS) represents a notable evolution within the banking sector, providing financial services through third-party providers via Application Programming Interfaces (APIs). The influence of Industry 4.0's digital transformation has been profound, fostering innovation and adaptability within the BaaS framework. Fintech integration has played a crucial role, as both emerging startups and established entities harness technology to elevate customer experience and streamline operational processes. Furthermore, advancements in technologies such as blockchain and artificial intelligence have significantly driven the adoption of BaaS, facilitating tailored services and operational efficiency. Within the market landscape of BaaS, traditional financial institutions, fintech enterprises, and major technology firms vie for market share, capitalizing on the increasing demand for versatile and personalized banking solutions.

Banking-as-a-Service (BaaS) Market Major Driving Forces

Digital Transformation: Ongoing digitalization within the banking sector, catalyzed by shifting consumer preferences and technological advancements, stands as a significant driver of BaaS adoption. BaaS enables banks to fortify their digital offerings, ensuring competitiveness in the contemporary digital landscape.

Cost Effective Solutions: BaaS presents an avenue for banks and financial institutions to achieve cost-efficient solutions by accessing specialized services and infrastructure without substantial investments in internal development and maintenance. This cost-effectiveness drives BaaS adoption, enabling improved operational efficiency and expedited time-to-market for new offerings.

Demand for Innovation: There exists a burgeoning demand for innovative financial services and solutions characterized by enhanced convenience, flexibility, and customization. BaaS facilitates the swift development and deployment of novel products and services, adeptly addressing the evolving demands of both consumers and enterprises.

Banking-as-a-Service (BaaS) Market Key Opportunities

Expansion in Emerging Markets: Emerging economies, characterized by rapid digitization and urbanization, present lucrative prospects for BaaS providers to broaden their scope and address the growing demand for digital financial services.

Integration of Emerging Technologies: The integration of emerging technologies like blockchain, artificial intelligence, and machine learning enables BaaS providers to bolster security, efficiency, and customization in financial services delivery, thereby capitalizing on opportunities for technological advancement.

Elevated Customer Experience: BaaS facilitates the delivery of personalized and innovative financial products and services, enabling banks and fintech entities to enhance customer satisfaction and loyalty, thereby capitalizing on opportunities for improved customer experience.

Banking-as-a-Service (BaaS) Market Key Trends

· The sector is experiencing a profound shift toward digitalization, fueled by evolving consumer preferences and technological advancements, leading to increased BaaS adoption among financial institutions.

· Globally, open banking initiatives are gaining momentum, fostering collaboration between banks and third-party providers, thereby stimulating innovation in financial services delivery through BaaS platforms.

· The emergence of neobanks, operating solely online and often leveraging BaaS solutions, is reshaping the banking landscape, intensifying competition by offering innovative and customer-centric financial products and services.

· Heightened concerns regarding data security and privacy prompt a greater emphasis on implementing robust security measures and regulatory compliance frameworks within BaaS platforms to safeguard customer data and maintain trust.

· BaaS providers increasingly integrate artificial intelligence and automation technologies into their platforms to bolster operational efficiency, personalize customer experiences, and offer predictive analytics capabilities.

Market Competition Landscape

The market competition landscape in Banking-as-a-Service (BaaS) is characterized by fierce rivalry among providers striving to differentiate their offerings through innovation and quality. Key competitive factors include technological advancements, regulatory compliance, customer service, and market reach. Partnerships and collaborations are common strategies, as firms seek to leverage each other's strengths and expand their market presence.

Key players in the global Banking-as-a-Service (BaaS) market implement various organic and inorganic strategies to strengthen and improve their market positioning. Prominent players in the market include:

· Stripe, Inc.

· Plaid Inc.

· Marqeta

· Solaris SE

· Banco Bilbao Vizcaya Argentaria, S.A.

· Galileo Financial Technologies, LLC

· Synapse Financial Technologies, Inc.

· Railsr

· Treasury Prime, Inc.

· ClearBank Ltd.

· Mambu

· 10x Banking Technology Limited

· Thought Machine Group Limited

· Cross River Bank

· Alkami Technology, Inc,

· OpenPayd Services Ltd.

· Finxact

· Aezion, Inc.

· Green Dot

· Q2 Software, Inc.

|

Report Attribute/Metric |

Details |

|

Base Year |

2022 |

|

Forecast Period |

2023 – 2030 |

|

Historical Data |

2018 to 2022 |

|

Forecast Unit |

Value (US$ Mn) |

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Segments Covered |

· By Service type (Core Banking, Payments, Compliance, and Others) · By Deployment Model (Cloud-based, and On-premises) · By End-User (Banks, Fintech companies, and Enterprises) |

|

Geographies Covered |

North America: U.S., Canada and Mexico Europe: Germany, France, U.K., Italy, Spain, and Rest of Europe Asia Pacific: China, India, Japan, South Korea, Southeast Asia, and Rest of Asia Pacific South America: Brazil, Argentina, and Rest of Latin America Middle East & Africa: GCC Countries, South Africa, and Rest of Middle East & Africa |

|

Key Players Analyzed |

Stripe, Inc., Plaid Inc., Marqeta, Solaris SE, Banco Bilbao Vizcaya Argentaria, S.A., Galileo Financial Technologies, LLC, Synapse Financial Technologies, Inc., railsr, Treasury Prime, Inc., ClearBank Ltd., Mambu, 10x Banking Technology Limited, Thought Machine Group Limited, Cross River Bank, Alkami Technology, Inc, OpenPayd Services Ltd., Finxact, Aezion, Inc., Green Dot, Q2 Software, Inc. |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |