Reports

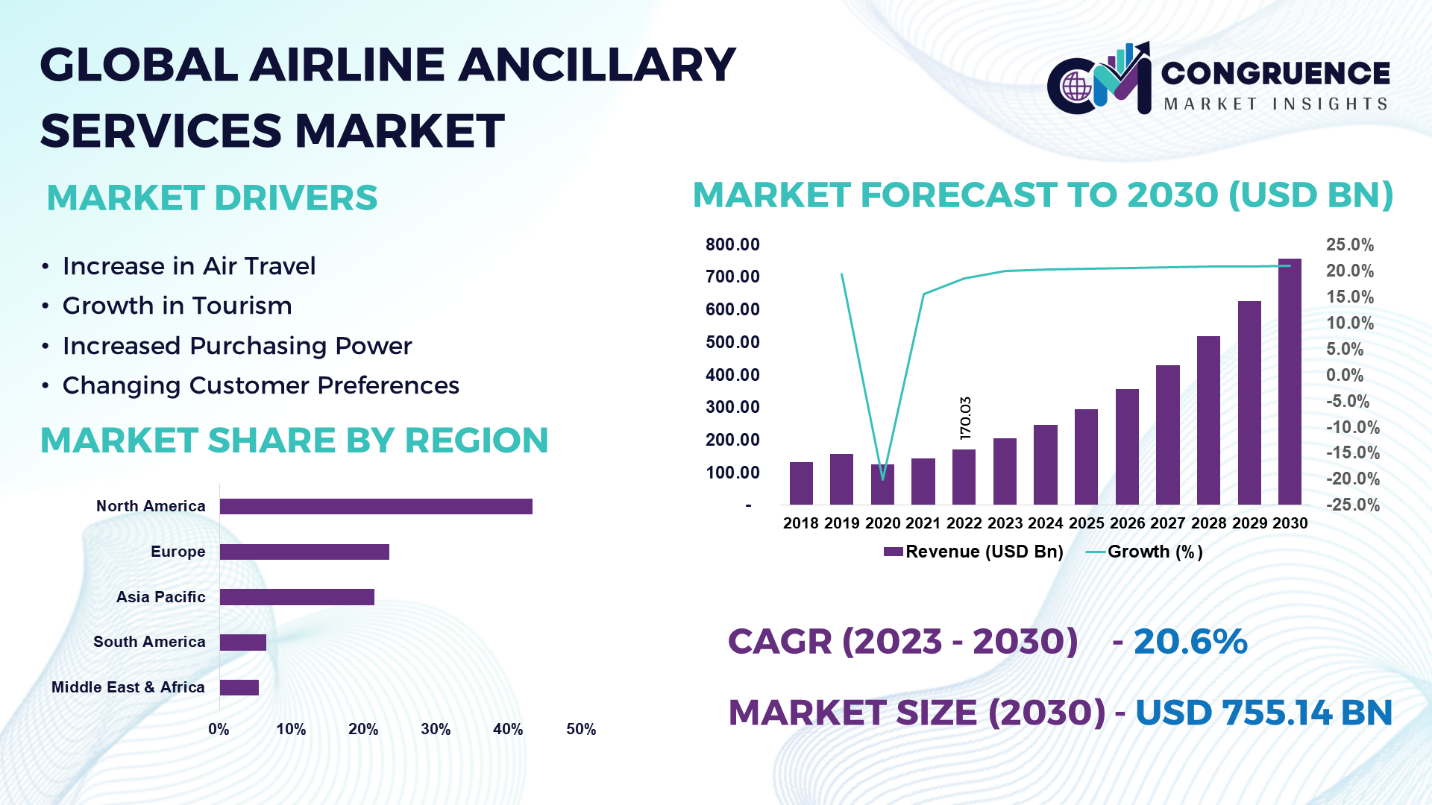

The Global Airline Ancillary Services Market was valued at USD 170.03 Billion in 2022 and is anticipated to reach a value of USD 755.14 Billion by 2030 expanding at a CAGR of 20.6% between 2023 and 2030.

Ancillary airline services are extra goods and services that airlines provide in addition to the standard airfare. These extra services are intended to improve consumers' overall travel experiences and give airlines new sources of income. Seat upgrades, priority boarding, in-flight entertainment, Wi-Fi access, additional baggage allowances, and meals are a few examples of airline ancillary services. Airlines actively promote these add-ons to meet the varied requirements and interests of their passengers, giving them the flexibility to personalize their travel experience. An important component of the airline industry's business model, the growing reliance on ancillary services helps carriers remain financially viable in a fiercely competitive market. The range and sophistication of auxiliary services are expected to change as airlines innovate and react to shifting consumer needs, significantly influencing the nature of contemporary air travel. Ancillary revenue, or money made from non-ticket sources including baggage fees, onboard meals, and services, makes up the airline ancillary industry. Concessions at sporting events, restaurant revenue collected by hotel owners, baggage handling or seat selection, and car wash services sold by gas stations are just a few examples of services that generate income.

Airline Ancillary Services Market Major Driving Forces

Increase in Air Travel: The increase in middle-class people's discretionary income worldwide is the main factor behind the sharp rise in air travel. This is thus generating demand in the aviation industry for supplementary services.

Growth in Tourism: More and more people are spending money on traveling and going on vacations, which is making the airline industry grow bigger since people are also buying extra things and services from airlines.

Increased Purchasing Power: When people have more money to spend, they buy things that make them feel comfortable and pay for extra services, which helps the market to grow.

Changing Customer Preferences: When traveling, travelers are looking for more comfort, convenience, and customized experiences. Due to this, there is a need for supplemental services that satisfy these inclinations.

Airline Ancillary Services Market Key Opportunities

In-Flight Wi-Fi: In the upcoming years, it is anticipated that in-flight Wi-Fi will become more widely used, which will create new prospects for the airline ancillary services sector.

Personalized Ancillary Services: Airlines have the opportunity to leverage the increasing demand for individualized experiences by providing customized supplementary services. This covers specialized dining experiences, tailored in-flight entertainment selections, and customizable travel packages.

Ancillary Services for Niche Business Areas: Airlines might investigate unexplored market niches by providing specialized supplementary services to cater to niche segments. Services for families, adventure seekers, or business travelers, for instance, can draw in new clientele and provide new revenue streams.

Airline Ancillary Services Market Key Trends

· With a growing percentage of their money coming from various sources, ancillary services have grown to be a significant source of income for airlines.

· Airlines are adding a variety of extra services to their portfolios, such as priority boarding and seat selection.

· Technology integration has been essential to the marketing and provision of supplementary services.

· Airlines are emphasizing the ancillary service experience's personalization by adjusting their offers to suit the requirements and tastes of each individual passenger.

· For airlines looking to gain a competitive edge, ancillary services have emerged as a major battleground.

· In an effort to give customers greater value, airlines are experimenting with combining several supplementary services into packages.

· A few airlines are introducing environmentally beneficial add-ons, such carbon offset schemes or eco-friendly in-flight merchandise.

Region-wise Market Insights

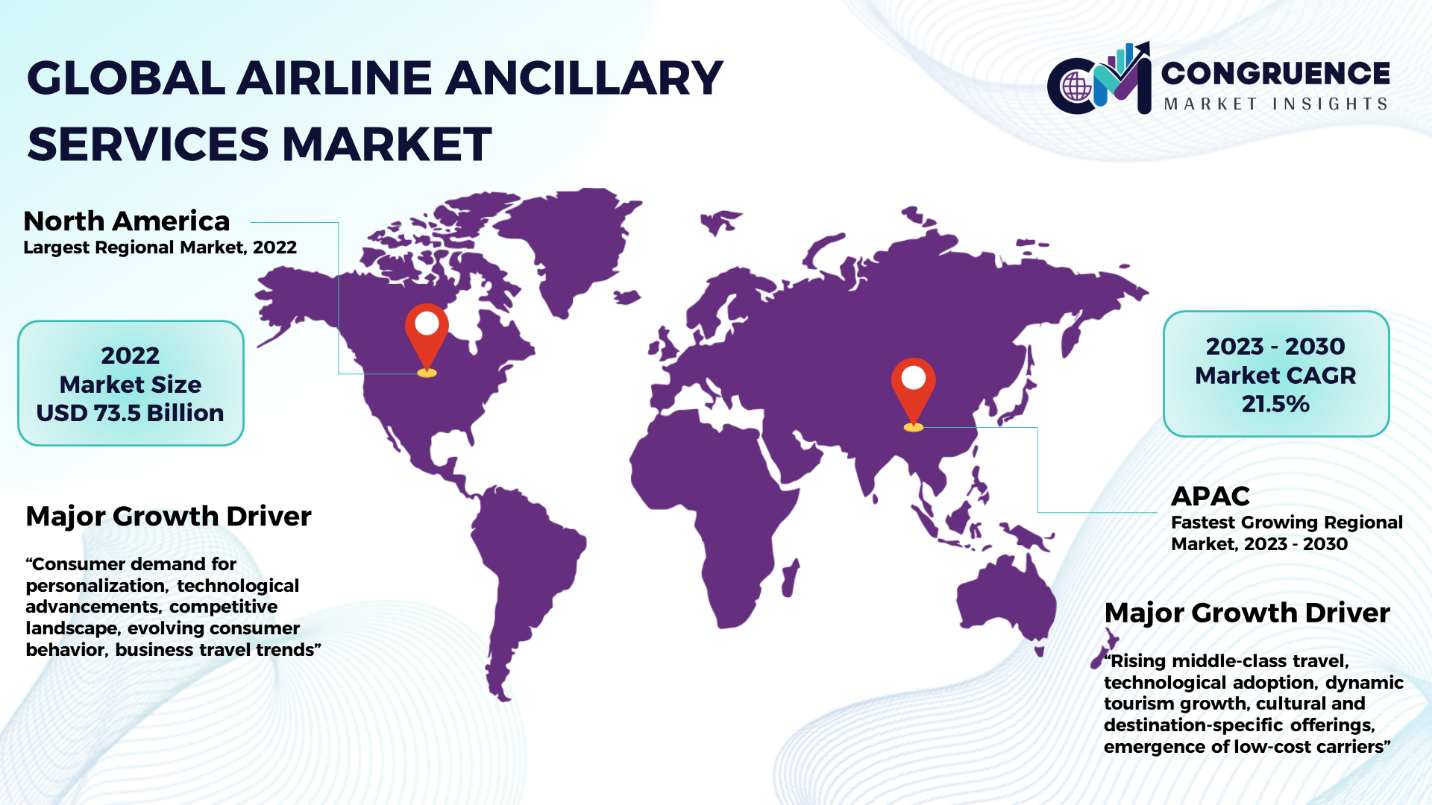

North America accounted for the largest market share at 43.2% in 2022 whereas, Asia Pacific is expected to register the fastest growth, expanding at a CAGR of 21.5% between 2023 and 2030.

North America holds the largest market share of 43.2%, accounting USD 73.5 Billion in global airline ancillary services market. The market in this region is driven by increase in consumer demand for personalization and customization, technological advancements of the market, evolving consumer preferences regarding ancillary services, increase in business travel, partnerships and alliances with other companies, strict regulatory environment in various nations and environmental considerations. Asia-Pacific is the region which is expected to have the largest CAGR of 21.5% during the forecast period. The market in this region is driven by the rising middle-class travel trend which has led to a surge in technological adoption within the tourism industry, dynamic tourism growth, cultural and destination-specific offerings, emergence of low-cost carriers, business and luxury travel expansion, partnerships with local businesses, government initiatives and infrastructure development, regulatory changes and liberalization and environmental awareness. Europe holds the second largest market share of 23.5% in this market. Market in this region is driven by the growth of technological advancements and dynamic growth in tourism industry.

Market Competition Landscape

The competitive environment of the airline ancillary services is defined by the existence of both domestic and international rivals. The airline ancillary services sector has consolidated as a result of mergers and acquisitions, wherein larger companies have acquired smaller firms in order to strengthen their market position and expand their capabilities. Due to this trend, notable companies with a wide range of products and services and a global presence have emerged. Innovative technologies are being quickly adopted by businesses in the airline ancillary services in order to improve project efficiency, safety, and environmental sustainability. Businesses having a wide geographic reach are better able to access a variety of markets and possibilities. They can increase their market share and diversify their project portfolio by utilizing their regional or worldwide footprints.

Key players in the global airline ancillary services market implement various organic and inorganic strategies to strengthen and improve their market positioning. Prominent players in the market include:

· Amadeus IT Group

· Sabre Corporation

· Travelport

· Datalex

· Guestlogix (now part of Sabre Corporation)

· SITA

· IATA (International Air Transport Association)

· Airlines (e.g., Delta, United, Emirates)

· Accelya (formerly Mercator)

· CellPoint Digital

· CarTrawler

· Farelogix (Acquired by Accelya)

· Routehappy (Now ATPCO)

· AirAsia Group

· Boxever (Acquired by Sitecore)

· GoQuo

|

Report Attribute/Metric |

Details |

|

Market Revenue in 2022 |

USD 170.03 Billion |

|

Market Revenue in 2030 |

USD 755.14 Billion |

|

CAGR (2023 – 2030) |

20.6% |

|

Base Year |

2022 |

|

Forecast Period |

2023 – 2030 |

|

Historical Data |

2018 to 2022 |

|

Forecast Unit |

Value (US$ Bn) |

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Segments Covered |

· By Type (Baggage Fees, Onboard Retail, Airline Retail, FFP Miles Sale, Others) · By Carrier Type (Full-Service Carrier, Low-Cost Carrier) · By Trip Purpose (Business and Leisure Travel) · By Service Type (In-Flight And Ground Services) |

|

Geographies Covered |

North America: U.S., Canada and Mexico Europe: Germany, France, U.K., Italy, Spain, and Rest of Europe Asia Pacific: China, India, Japan, South Korea, Southeast Asia, and Rest of Asia Pacific South America: Brazil, Argentina, and Rest of Latin America Middle East & Africa: GCC Countries, South Africa, and Rest of Middle East & Africa |

|

Key Players Analyzed |

Amadeus IT Group, Sabre Corporation, Travelport, Datalex, Guestlogix (now part of Sabre Corporation), SITA, IATA (International Air Transport Association), Airlines (e.g., Delta, United, Emirates), Accelya (formerly Mercator), CellPoint Digital, CarTrawler, Farelogix (Acquired by Accelya), Routehappy (Now ATPCO), AirAsia Group, Boxever (Acquired by Sitecore), GoQuo |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |