Reports

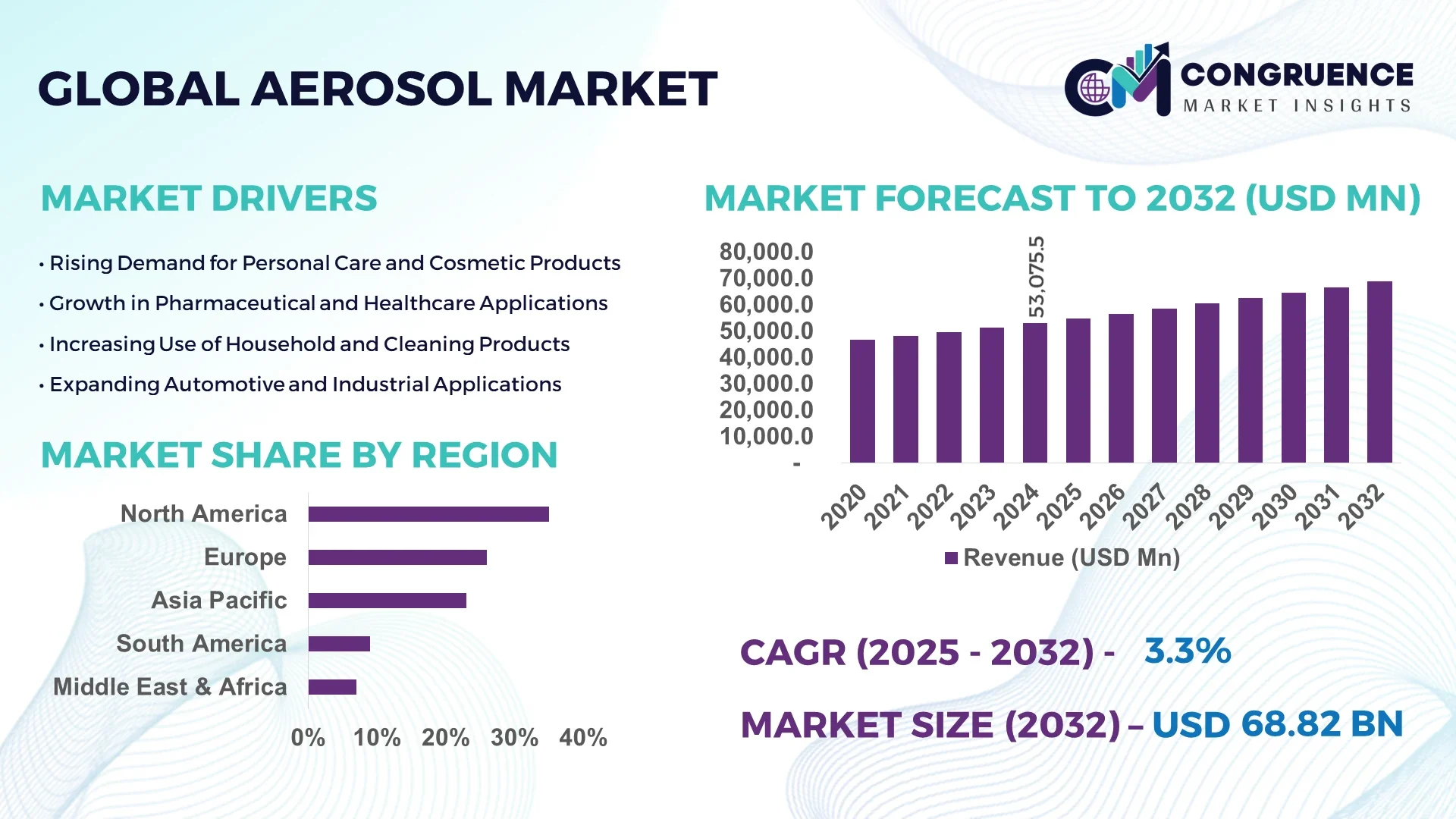

The Global Aerosol Market was valued at USD 53,075.54 Million in 2024 and is anticipated to reach a value of USD 68,817.19 Million by 2032, expanding at a CAGR of 3.3% between 2025 and 2032.

The aerosol market has witnessed significant growth, driven by increasing consumer demand across various sectors. In 2023, the aluminum segment accounted for the largest revenue share, comprising 60.8% of the global aerosol market. The personal care segment led the market, propelled by rising demand for products like deodorants and hair sprays. Additionally, the household segment experienced rapid growth, influenced by improved living standards and a heightened focus on hygiene. The Asia-Pacific region, particularly India, emerged as a key growth driver, with the Indian aerosol market projected to reach USD 3,481.3 million by 2030. This expansion is attributed to the growing demand for aerosol products in personal care, household, and automotive applications, coupled with the adoption of aerosol packaging for its convenience and portability.

Artificial Intelligence (AI) is revolutionizing the aerosol market by enhancing forecasting accuracy and operational efficiency. In December 2024, researchers developed the AI-GAMFS system, which delivers reliable 5-day, 3-hourly forecasts of aerosol optical components and surface concentrations at a 0.5° x 0.625° resolution. This advancement enables better air quality warnings, health risk assessments, and climate change mitigation efforts. AI's integration into aerosol forecasting systems has significantly improved the prediction of aerosol behaviors, such as dust storms and wildfires, by capturing complex aerosol-meteorology interactions through global attention and spatiotemporal encoding. This leap in forecasting capabilities marks a significant step forward in leveraging AI to refine physics-based aerosol forecasting, facilitating more accurate global warnings for aerosol pollution events.

"In December 2024, the AI-GAMFS system was introduced, enhancing aerosol forecasting by delivering 5-day, 3-hourly predictions of aerosol optical components and surface concentrations. This development improves global aerosol pollution predictions and supports air quality management efforts."

The aerosol market is influenced by various dynamics that shape its growth trajectory. Key factors such as rising demand for personal care products, stringent regulations on production and disposal, and technological advancements continue to drive changes in market dynamics. The ability of aerosol products to offer convenience, portability, and precise dispensing makes them increasingly popular in multiple applications, including personal care, household products, and pharmaceuticals. Furthermore, environmental concerns and advancements in eco-friendly aerosol solutions are pushing manufacturers to innovate while complying with regulations that limit harmful emissions.

Rising Demand for Personal Care Products

The aerosol market is experiencing significant growth due to the increasing demand for personal care products. Items such as deodorants, hair sprays, and shaving creams are driving the adoption of aerosol packaging. Consumers favor aerosol products for their convenience, hygiene, and ease of use. The ability of aerosol packaging to provide precise dispensing, maintain product freshness, and enhance portability has further fueled its popularity in the personal care segment. Additionally, the growing global focus on personal grooming and self-care, particularly among younger demographics, is driving higher consumption of personal care products, thereby supporting the expansion of the aerosol market. This trend is further amplified by innovation in aerosol formulations, such as eco-friendly and sustainable packaging options, catering to the evolving preferences of environmentally conscious consumers.

Stringent Regulations on Aerosol Production and Disposal

The aerosol market faces challenges due to stringent regulations on aerosol production and disposal. Regulatory bodies across various regions impose strict guidelines to address concerns related to the environmental impact of aerosol products, particularly the emission of volatile organic compounds (VOCs) and the disposal of pressurized containers. Compliance with these regulations requires manufacturers to adopt advanced technologies and environmentally friendly formulations, which can increase production costs and complexity. Additionally, disposal regulations mandate specialized handling and recycling processes for aerosol cans, further adding to logistical and operational challenges. These regulatory constraints can slow down innovation, limit market expansion, and create barriers for smaller players, potentially affecting the overall growth trajectory of the aerosol market.

Growth in Personalized Medicines

The aerosol market presents opportunities in the growth of personalized medicines. The increasing demand for personalized healthcare solutions is driving the development of aerosol-based drug delivery systems. Aerosol formulations offer precise and controlled administration of medications, enhancing patient compliance and treatment efficacy. The adoption of aerosol technology in personalized medicine is expanding across various therapeutic areas, including respiratory diseases and localized treatments. With advancements in aerosol technology, these systems enable more effective drug delivery and improve patient outcomes, especially in chronic conditions where consistent medication management is critical. This opportunity aligns with the growing shift toward tailored healthcare, fostering further growth in the aerosol market.

Rising Costs and Expenditures

The aerosol market faces challenges related to rising costs and expenditures, particularly in raw materials and packaging. Manufacturers are required to meet environmental standards while maintaining cost-effective production processes. The increasing demand for eco-friendly packaging, coupled with the need for compliance with stringent regulations, adds financial pressure to producers. These rising operational costs, especially in aerosol production involving specialized cans and propellants, may limit the profitability of aerosol manufacturers, particularly smaller companies. Furthermore, fluctuations in raw material prices and global supply chain disruptions are contributing to cost volatility, presenting additional hurdles for market players seeking to remain competitive.

The aerosol market is experiencing several notable trends that are shaping its future. One prominent trend is the growing demand for eco-friendly aerosol products. Consumers are increasingly seeking products with sustainable packaging and formulations that have minimal environmental impact. In response, manufacturers are exploring alternatives to traditional propellants, such as compressed air, that reduce the environmental footprint of aerosol products. Additionally, the rise of premium personal care items and a focus on innovation in aerosol formulations are boosting market growth. In particular, aerosol-based products in the health and wellness sector, such as inhalers and air purifiers, are becoming more common due to their convenience and efficacy. Moreover, the increasing popularity of smart aerosol systems, particularly in home automation and personal care, is contributing to the advancement of the aerosol market. The shift towards digitalization and connected devices in various aerosol applications further signifies the changing landscape of the industry. These trends indicate a dynamic and rapidly evolving aerosol market driven by consumer preferences and technological innovations.

The aerosol market is segmented based on type, application, and end-user insights. Each segment plays a significant role in driving the market's growth and development. The market is broadly divided into aerosol propellants, containers, valves, fillers, and pumps. These components are integral to the performance and functionality of aerosol products. In terms of application, aerosols are widely used across personal care and cosmetics, household products, automotive and industrial uses, food and beverages, pharmaceuticals, and cleaning and disinfecting products. The diversity in applications highlights the widespread use and demand for aerosol-based products. Moreover, end-user insights reveal varying trends across households, commercial enterprises, and industrial applications, with each sector demanding different product functionalities. Understanding the segmentation helps stakeholders target the right market segments effectively and cater to the evolving needs of consumers.

The North American region accounted for the largest market share at 35% in 2024; however, the Asia-Pacific region is expected to register the fastest growth, expanding at a CAGR of 4.5% between 2025 and 2032.

North America remains a dominant player due to its well-established demand for aerosol products, especially in personal care, pharmaceuticals, and household products. The region's robust distribution networks and technological advancements in aerosol delivery systems contribute significantly to its market share. Conversely, Asia-Pacific is witnessing rapid urbanization, rising disposable income, and growing consumer demand for convenient, ready-to-use aerosol products, driving the region’s high growth potential over the next decade. Europe also maintains a strong market presence, while the Middle East & Africa is poised to grow steadily due to the increasing demand for aerosols in the industrial and cleaning sectors.

Leading the Charge in Eco-Friendly Aerosols

North America dominates the global aerosol market, accounting for 35% of the total market share in 2024. The demand is primarily driven by the personal care and cosmetics sector, where products such as deodorants, hairsprays, and perfumes are highly popular. The rise in health-conscious consumers and the increasing focus on hygiene and cleanliness have also fueled the demand for household aerosol products, including air fresheners and disinfectants. Additionally, the industrial sector in North America is experiencing significant growth, particularly in automotive maintenance and machinery lubrication, further contributing to the regional market share. Regulatory standards and the preference for sustainable, eco-friendly products are also influencing the trends in the region.

Pioneering Sustainable and Green Aerosol Solutions

Europe is a significant player in the aerosol market, accounting for approximately 30% of the global market share in 2024. The region's demand for aerosol products is primarily driven by personal care and cleaning applications. European consumers' preference for convenience and eco-friendly packaging has led to a rise in demand for sustainable aerosol products, particularly in the personal care segment. Moreover, the growing industrial demand for aerosol lubricants and sprays, especially in the automotive and manufacturing sectors, contributes to the region's growth. The European market also faces stringent environmental regulations, which are pushing manufacturers to adopt more environmentally responsible propellants and packaging solutions. This shift is expected to shape future trends in the market.

Rapid Urbanization Boosting Aerosol Demand

Asia-Pacific is set to experience the highest growth rate in the aerosol market, driven by rising urbanization, an expanding middle class, and increased disposable incomes. In 2024, the region held about 25% of the global market share. Aerosol-based products, especially in personal care, household cleaning, and automotive sectors, are in high demand. Countries like China, India, and Japan are major contributors to this growth, as consumers seek more convenient and ready-to-use products. Additionally, the increasing awareness of environmental sustainability is prompting the region to adopt eco-friendly aerosol products, leading to the development of new propellants and packaging materials that align with environmental standards. The Asia-Pacific market is expected to continue expanding due to rapid urban development and evolving consumer preferences.

Hygiene and Industrial Growth Fueling Aerosol Adoption

The Middle East & Africa (MEA) aerosol market is growing steadily, contributing to around 10% of the global market share in 2024. The demand for aerosol products in this region is particularly strong in the cleaning, disinfecting, and personal care sectors. The increased focus on hygiene, especially in light of the COVID-19 pandemic, has driven the growth of cleaning and disinfectant aerosols. Additionally, the growing industrial sector in the Middle East, particularly in oil and gas, is increasing the demand for aerosol lubricants and sprays. The region is also seeing a shift toward more sustainable aerosol products, with consumers and businesses alike seeking eco-friendly packaging and propellants. The MEA region's growing urbanization and expanding retail networks are likely to further propel market growth in the coming years.

The aerosol market is highly competitive, with several key players striving for market share through innovation, product differentiation, and expanding their geographic presence. The market is dominated by large multinational corporations that offer a wide range of aerosol products for various applications, including personal care, pharmaceuticals, automotive, and household products. In 2024, leading companies such as Reckitt Benckiser, Procter & Gamble, and Unilever continue to maintain strong positions through their well-established brands and extensive distribution networks. These companies are focusing on introducing eco-friendly and sustainable products to align with growing consumer demand for environmentally responsible packaging. Moreover, new entrants and regional players are capitalizing on emerging market opportunities in Asia-Pacific and the Middle East & Africa. The competitive landscape also features the development of smart aerosol delivery systems, further enhancing the consumer experience and product functionality.

Reckitt Benckiser Group

Procter & Gamble Co.

Unilever

Henkel AG & Co. KGaA

SC Johnson Professional

Kimberly-Clark Corporation

L'Oréal Group

Air Products and Chemicals Inc.

AkzoNobel N.V.

Coster Tecnologie Speciali S.p.A.

The aerosol market is experiencing significant technological advancements that enhance product performance, sustainability, and consumer convenience. One notable innovation is the development of propellant-free aerosol systems, such as APS's twistMist introduced in June 2023. This system utilizes manual activation mechanisms, eliminating the need for traditional pressurized gases and enabling the use of recyclable materials like HDPE, PET, metal, or glass for packaging. Additionally, advancements in precision dispensing technologies, including nozzle-based systems and smart dispensing units equipped with sensors and IoT connectivity, are gaining traction. These technologies offer enhanced control over aerosol application, monitor usage, and contribute to overall efficiency in technical processes. Furthermore, the integration of nano aerosol technology allows for more precise and targeted applications, making them suitable for advanced technical applications. Manufacturers are also focusing on developing eco-friendly formulations, such as water-based formulations, biodegradable propellants, and recyclable packaging, to reduce environmental impact and align with sustainability goals.

In June 2024, LAPP introduced the ETHERLINE® FD bioP Cat.5e, its first bio-based Ethernet cable produced in series. This sustainable variant features a bio-based outer sheath composed of 43% renewable raw materials, reducing the carbon footprint by 24% compared to traditional fossil-based TPU sheaths.

In March 2024, Procter & Gamble patented an aerosol package design that uses adsorbent materials as propellants to maintain pressure. A bag, can, and valve with an adsorption matrix of MOF and carbon dioxide are included in the package, which guarantees pressure stability throughout its useful life.

In September 2023, Beiersdorf announced that every deodorant can in the European selection of NIVEA, 8X4, Hidrofugal, and Hansaplast would weigh 11.6% less and contain at least 50% recycled aluminum. As a result, the aerosol can value chain's CO2 emissions will drop by almost 58%. This translates to an annual decrease of about 30 tons of CO2.

In May 2024, BASF launched the SUWEIDA natural pyrethrin pesticide aerosol in China. Formulated with pyrethrin, a natural insecticide extracted from the pyrethrum flower, the product is recognized for its low toxicity to humans and pets. Designed for efficient pest control targeting mosquitoes, flies, and cockroaches, the aerosol features an innovative nozzle that delivers precise doses while reducing environmental impact.

In October 2024, Aero Pump partnered with Resyca to introduce the cutting-edge Ultra Soft Nasal Pump Spray. Designed to deliver a fine aerosol, the spray ensures uniform distribution across the nasal cavities, potentially enhancing immune response. This innovation presents a compelling alternative to traditional injectable vaccines.

The aerosol market report offers a detailed analysis of the global aerosol industry, covering key market segments, technological advancements, and future opportunities. It encompasses various types of aerosols, including aerosol propellants, containers, valves, fillers, and pumps, along with a deep dive into the application sectors such as personal care, pharmaceuticals, food and beverages, and industrial products. The report also explores end-user insights, focusing on households, commercial enterprises, and industrial applications, and examines regional market trends across North America, Europe, Asia-Pacific, and the Middle East & Africa.

The scope of this report includes emerging technologies such as eco-friendly aerosol formulations, precision dispensing systems, and the growing trend of propellant-free aerosol products. It highlights the rising demand for sustainable packaging solutions and regulatory advancements that impact production and distribution. The report identifies key market drivers, such as the increasing need for personal care products, along with challenges like regulatory compliance and environmental concerns. Market opportunities are explored in areas like personalized medicines and eco-friendly packaging. This comprehensive analysis equips stakeholders with valuable insights to navigate the evolving market, assess investment opportunities, and make informed decisions within the aerosol sector.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 53,075.54 Million |

|

Market Revenue in 2032 |

USD 68,817.19 Million |

|

CAGR (2025 - 2032) |

3.3% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Reckitt Benckiser Group, Procter & Gamble Co., Unilever, Henkel AG & Co. KGaA, SC Johnson Professional, Kimberly-Clark Corporation, L'Oréal Group, Air Products and Chemicals Inc., AkzoNobel N.V., Coster Tecnologie Speciali S.p.A. |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |